The accrual method complies with generally accepted accounting practices (GAAP) because it recognizes costs and expenses when they happen, not when the money changes hands, and utilizes double-entry accounting. Cash accounting, as it only considers current cash flow, often provides an inaccurate overview of the financial health and performance of the organization. Cash accounting is not recognized by GAAP and is mainly preferred by smaller organizations with fewer transactions and who generally do not offer payment terms such as credit options. This ensures that prepaid expenses are systematically recognized over time rather than as a single expense upfront.

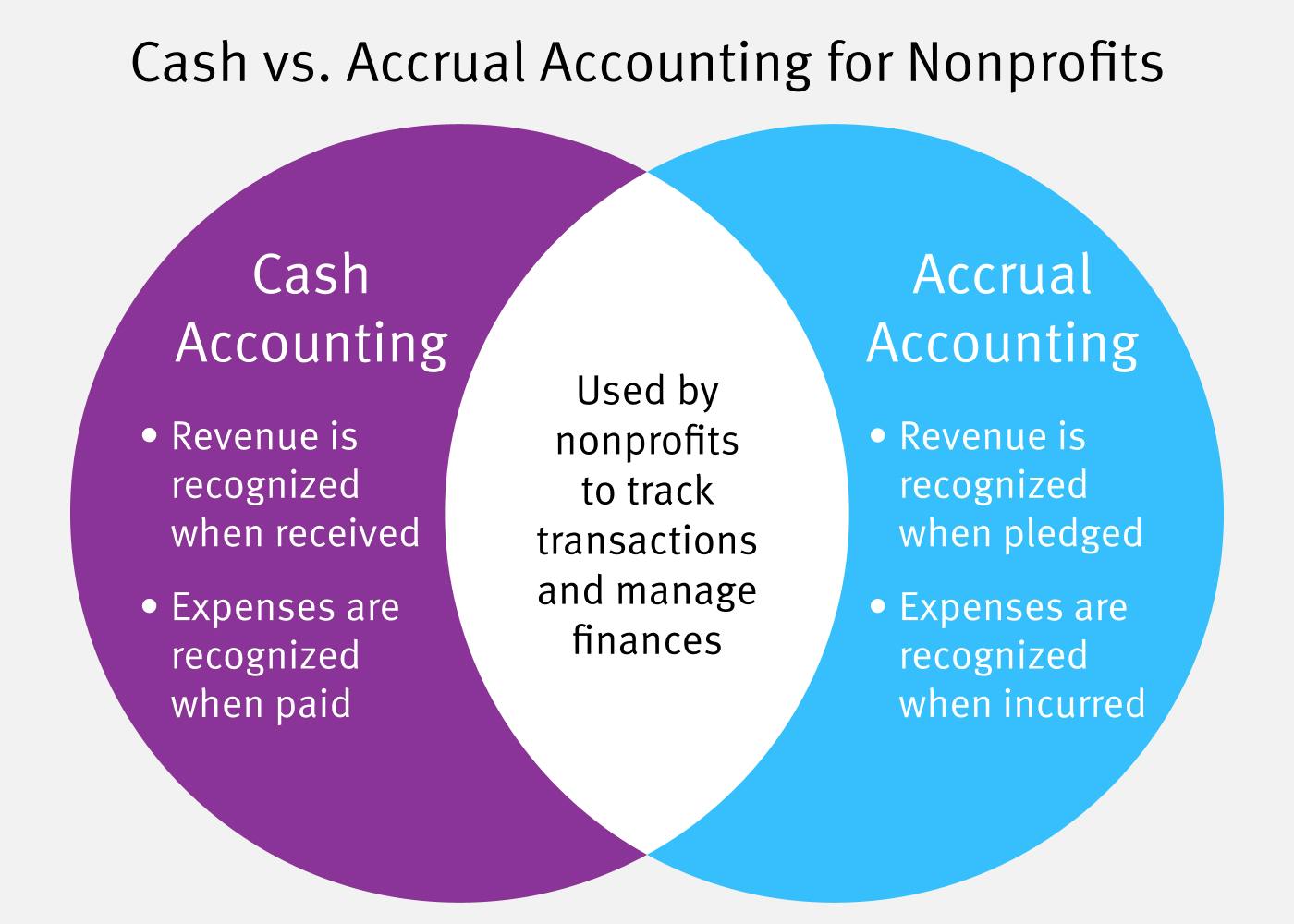

How Does It Differ From Cash Accounting?

The rules for recording accruals are generally the same as the rules for recording other transactions in double-entry accounting. The specific journal entries will depend on the individual circumstances of each transaction. A company can measure what it owes in the short term and also what cash revenue it expects to receive by recording accruals. It also allows a company to record assets that don’t have a cash value such as goodwill.

To Ensure One Vote Per Person, Please Include the Following Info

If the business is run by a sole proprietor and only deals in cash, then cash basis accounting might be the right accounting method. But, in most cases, accrual accounting makes better financial sense, especially as the company grows and begins to require accountability to stakeholders. Companies that use accrual accounting sell on credit, so projects that provide revenue streams over a long period affect the company’s financial condition at the point of transaction. It makes sense to use accrual accounting so these events can be reflected in the financial statements during the same reporting period that these transactions occur. Accrual accounting is an accounting method in which the accountant records revenues and expenses when they are earned or owed, regardless of when the cash is actually received or paid out. While accrual accounting provides a more accurate financial picture of a company’s operations, it is not without its challenges.

Difference Between Cash and Accrual Accounting

Accrual accounting stands as a cornerstone in the realm of financial reporting, offering a more accurate picture of a company’s financial health compared to cash accounting. This method records revenues and expenses when they are earned or incurred, regardless of when the cash transactions actually occur. Accrual accounting is widely used in various industries and is the preferred method of accounting for most businesses.

- These programs can automatically generate and track invoices, record expenses, and reconcile bank accounts, making it easier to stay on top of your financials.

- Accrual accounting differs from cash accounting because it includes revenue that has yet to be collected (accounts receivable) and expenses that have yet to be paid out (accounts payable).

- Here, Y will create a prepaid expense account to show the payment received for the service/product company X has to receive.

- Some of these indirect expenses may not have been paid by the end of that month, despite being accrued in that period.

- By analyzing accrued revenues and expenses, businesses can identify seasonal fluctuations, growth trends, and potential financial challenges.

The method ensures that financial statements more accurately and comprehensively represent a company’s ongoing financial activities. It’s a fundamental aspect of contemporary accounting, providing a timely reflection of the true economic state of business how do you calculate the gain or loss when an asset is sold operations. This underscores its importance in providing a realistic view of a company’s financial health. For instance, while most of our favorite outsourced accounting services offer both the accrual and cash methods, some offer cash basis only.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. For example, a company purchasing equipment for $50,000 with a 5-year useful life might recognize $10,000 as a depreciation expense each year. Depreciation is the allocation of a tangible asset’s cost over its useful life, reflecting its gradual wear and tear. Managers can review and approve expenses directly through email, Slack, or Fyle’s mobile app, thanks to configurable workflows.

Both are essential for accurate financial reporting, as they work together to represent a company’s performance in a given period. Accrual accounting also requires the use of journal entries and double-entry accounting, which ensures that all transactions are properly recorded and balanced. This provides a clear and accurate record of a company’s financial activities, making it easier to prepare financial statements and comply with tax laws. Moreover, accrual accounting provides valuable insights into trends and patterns that might not be evident under cash accounting. By analyzing accrued revenues and expenses, businesses can identify seasonal fluctuations, growth trends, and potential financial challenges.

As soon as you sell a product, it records the cost of goods sold (COGS), which gives you a better idea of your true profit on each sale. Recording cash transactions based on when you complete services, deliver products, and incur expenses is also beneficial to your business. Differently than accrued revenue, deferred revenues happen when a customer has paid for a good or service you haven’t yet provided.

Expense accruals involve recording expenses that have been incurred but not yet paid. This type of accrual ensures that expenses are matched with the revenues they help generate, providing a clearer view of a company’s profitability. For instance, a company may receive a utility bill in January for services used in December. Under accrual accounting, the expense would be recorded in December, the period in which the utility services were consumed.